The Ministry of Finance (MoF) announced that starting from 1 June 2018 , the rate of the Goods and Service tax (GST) will be reduced to 0% from the current 6%. For more information regarding the change and guide, please refer to: Malaysia GST Reduced to Zero

GST is known as Value Added Tax (VAT) that is claimable by GST registered business.

View our GST video summary to better understand our services that we provide:

GST is levied on the supply of goods and services at each stage of the supply chain from the supplier up to the retail stage of the distribution. Even though GST is imposed at each level of the supply chain, the tax element does not become part of the cost of the product because GST paid on the business inputs is claimable. Hence, it does not matter how many stages where a particular good and service goes through the supply chain because the input tax incurred at the previous stage is always deducted by the businesses at the next step in the supply chain.

GST is a broad based consumption tax covering all sectors of the economy i.e all goods and services made in Malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the Minister of Finance and published in the Gazette.

Generally, once you are GST registered, you are responsible for:

– Account for GST on taxable supplies made and received, ie output tax and input tax respectively

– Submit GST return (GST-03) and pay tax not later than last day of following month after taxable period

– Issue tax invoice on any supply unless as allowed by Customs

– Inform Customs of the cessation of business within 30 days from the date of business cessation

– Inform Customs of any changes of address, taxable activity, accounting basis and taxable period

– Keep adequate records of all business transactions relating to GST in the National or English language for 7 years.

Standard-rated supplies are goods and services that are charged GST with a standard rate. GST is collected by the businesses and paid to the government. They can recover credit back on their inputs. If their input tax is bigger than their output tax, they can recover back the difference.

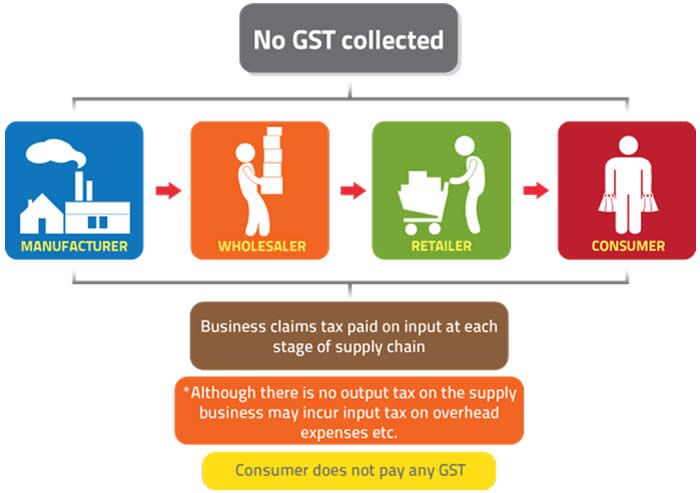

This means that only the consumer are required to pay for the 6% GST and GST is claimable for manufacturer, wholesaler and retailer.

There are taxable supplies that are subject to a zero rate. Businesses are eligible to claim input tax credit in acquiring these supplies, and charge GST at zero rate to the consumer.

Examples of taxable supplies that are subject to a zero rate are exports, agriculture products, livestock supplies, poultry, egg, treated water and the first 200 units of electricity to domestic users. Some of the product that falls into the categories include fresh vegetables, live animals, unprocessed meat and fish.

Deemed Supplies includes business gift which more than RM 500, private use of business assets, supply of services to connected persons and others.

Disregarded Supplies includes supplies of goods under warehousing scheme, supplies between venture operator and venturers, supplies by toll manufacturer to his overseas principle and others.

There are non-taxable supplies that are not subject to GST. Businesses are not eligible to claim input tax credit in acquiring these supplies, and cannot charge output tax to the consumer.

Consumer are not required to pay any GST for exempt supplies such as medical services, sale and lease of residential property, financial services, toll highway, private health and education, domestic transportation, land for agricultural purposes and land for general use.

Composite supply refers to a single supply with more than one component. Where a supply appears to consist of more than one component, the supply is still a single supply if there is clearly one overall supply being made to which the remaining components can be seen as integral, incidental or tie-in.

A supply of services shall be deemed as made

(a) in Malaysia, if the supplier belongs in Malaysia; and

(b) in another country, if the supplier belongs in the other country.

Export of services can be a Standard-Rated Supplies or Zero Rated Supplies in Malaysia.

A supplier who does not belong in Malaysia and supplies services to a customer in Malaysia does not have to charge GST. However, the customer who receives the services for the purpose of any business carried on by him is required to account for GST by a reverse charge mechanism.

When services are imported from outside Malaysia and supplied to a recipient in Malaysia, being taxable supplies if made in Malaysia, the recipient of the supply shall account and pay GST if such imported services are for the business purposes and consumed in Malaysia. He shall account for output tax on the portion of the services consumed in Malaysia. If the recipient is a taxable person, he is entitled to claim input tax on the services if the imported services are used for making taxable supplies.

If the recipient is not a taxable person, he is still required to account the GST as output tax and declare the tax in a prescribed form (Form GST-04). The tax has to be paid not later than the last day of the subsequent month from the month in which the payment of supply is made.

Effective on 1 January 2017, the time of supply of imported services shall be treated to have been made at the following dates whichever is the earlier:

(a) the date when any payment is made by the recipient; or

(b) the date when any invoice is received from the supplier who belongs in a country other than Malaysia or who carries on business outside Malaysia.

The value for imported services is tax exclusive.

A recipient does not need to issue any tax invoice when he receives an imported service. But for audit purpose, the recipient should keep the invoice he receives from the overseas supplier.

For online submission of Form GST-04, can see here.

The time of supply is the time when a supply of goods or services is treated as being made. It is important to determine the time of supply because a taxable person must charge GST at the time when the supply is made. Consequently he accounts for GST for the taxable period in which the time of supply occurs unless he is allowed to account GST under a payment basis.

In general, the basic tax point is when:

(a) goods are removed or when goods are made available to a customer; or

(b) services are performed.

If a supplier issues a tax invoice or receives any payment before the time of supply mentioned in above, the time of supply for the amount invoiced or payment received will be the date of the invoice issued or the amount of payment received, whichever is the earlier.

Besides, If a supplier does not receive any payment before the basic tax point (when good delivered or services rendered) but issues a tax invoice within twenty one (21) days from the basic tax point, the time of supply will be the date of issuance of the invoice. This is regardless if any payment is received within the twenty one (21) day period. If a tax invoice is not issued within twenty one (21) days, then the time of supply will revert to the basic tax point (date of good delivered or services rendered).

All documents related to exportation must be kept for a period of seven years. Any failure to do so is an offence under GST Act 2014. Documents that have to be kept are as follows:

(a) Export declaration (form K2 / K8) with endorsement on Remarks column in Sistem Maklumat Kastam (SMK), “A claim for input tax under the GST Act 2014 will be made”;

(b) Permit to transship or remove goods (K8) e.g. Goods removed for outright export from Free Industrial Zone, Pulau Pinang to LTA Bayan Lepas, Pulau Pinang or goods removed from Public Bonded Warehouse to LTA Bayan Lepas, Pulau Pinang;

(c) Customs Official Receipt (COR);

(d) Sales invoices;

(e) Bill of lading;

(f) Shipping note;

(g) Insurance note;

(h) Payment document, such as documentary credit, debit advice, bank statement, etc.;

(i) Debit and Credit note;

(j) Tally sheet from Port Authority;

(k) Short ship/short landed certificate; and

(l) Other documents related to export.

Click Exportation of Goods for more information.

Generally, all imported goods into Malaysia are subject to GST. However, certain goods imported by any person or class of persons are given relief from

payment of GST upon importation under the Goods and Services Tax (Relief) Order 2014.

All documents related to importation must be kept for a period of seven years. Any failure to do so is an offence under GST Act 2014. Documents that have to be kept are as follows:

(a) Import declaration (K1)

(b) Commercial invoice

(c) Bill of lading

(d) Shipping note

(e) Insurance note

(f) Payment document, such as documentary credit, debit advice, bank statement, etc.

(g) Sale invoices

(h) Debit and Credit note

(i) Shortage/short-landed certificate

(j) Tally sheet from Port Authority

(k) Official receipt from Custom (to prove the duty has been paid if any)

(l) Other related documents

Click Importation of Goods for more information.

The following information must be reflected on an invoice in order for it to be considered as a full tax invoice:-

(a) the word ‘tax invoice’ in a prominent place;

(b) the tax invoice serial number (Cannot be in random number);

(c) the date of issuance of the tax invoice;

(d) the name, address and identification number of the supplier *;

(e) the name and address of the person to whom the goods or services are supplied;

(f) a description sufficient to identify the goods or services supplied;

(g) for each description, distinguish the type of supply for zero rate, standard rate and exempt, the quantity of the goods or the extent of the services supplied and the amount payable, excluding tax;

(h) any discount offered;

(i) the total amount payable excluding tax, the rate of tax and the total tax chargeable to be shown separately;

(j) the total amount payable inclusive of the total tax chargeable; and

(k) any amount referred to in subparagraphs (i) and (j), expressed in a currency, other than Ringgit, shall also be expressed in Ringgit in accordance with paragraph 5 of the Third Schedule of the GSTA 2014.

* You are required to check GST Registration Status for A Business in Malaysia to ensure the tax invoice is valid for input tax claiming.

To avoid confusion on the customer, the GST registered person must not issue tax invoice when only making exempt supply or out of scope supply (non taxable supply). Besides, tax invoice shall not be issue for any supply of second-hand goods (margin scheme), any supply of imported services, and any supply of treated or processed goods which is deemed to have been supplied by the recipient under Approved Toll Manufacturer Scheme (ATMS). It is an offence if you fails to comply with the requirement of issuance of tax invoice.

According to DG’s decision 3/2015, A GST registered person is not allowed to issue any handwritten tax invoices. They must use a computer generated invoice or pre‐printed invoice which is GST compliant.

Duplicate copy of tax invoice – You should issue one original tax invoice for each transaction. If your customer request for a duplicate copy, may be due to damaged or lost tax invoice, then you may issue to him a copy marked “COPY ONLY” to enable the recipient to claim his input tax.

Electronic Tax Invoice – a registered person shall be treated as having issued a tax invoice to another person notwithstanding that there is no delivery of any equivalent document in paper form to the person if the requisite particulars are recorded in a computer and are:

(a) transmitted or made available to the person by electronic means; or

(b) produced on any material other than paper and is delivered to the person.

The intended recipients must confirm in writing that they are prepared to accept electronic documents under the conditions set out at point 62 at TAX INVOICE AND RECORDS KEEPING.

Invoice in a Foreign Currency – If a tax invoice is stated in a foreign currency, the following particulars in the tax invoice have to be converted into Ringgit Malaysia (RM) for GST purposes:-

(a) the amount payable before GST;

(b) the total GST chargeable; and

(c) the total amount payable (including GST).

The foreign currency is converted into Ringgit Malaysia by using selling rate of exchange prevailing in Malaysia at the time when the supply takes place. Such as Bank Negara Exchange Rate. In the case of importation, the importer can use the exchange rates published by Customs which are updated every week.

Simplified tax invoice refers to tax invoice without full particulars prescribed in regulation 22 GSTR and this tax invoice can only be issued by a registered person who has been granted approval by the DG.

Simplified tax invoice can be used to claim input tax credit. However, if this invoice does not have the name and address of the recipient, the maximum amount of input tax that can be claimed must not exceed RM30. If the GST amount in the simplified tax invoice is more than RM30.00 (e.g. RM50.00) and the recipient wants to claim the full amount, he has to request for his name and address to be inserted in the invoice. The registered person as to retain the original invoice, invalidate it and keep record of the cancelled tax invoice when the placement tax invoice with recipient’s name and address is issued.

According to DG’s Decision 3/2015, Every registered person who makes any taxable supply of goods or services in the course or furtherance of any business in Malaysia shall issue a tax invoice to his buyer within 30 days from the date of supply or the date of payment made on such supply (in full or in part). Failure to issue a tax invoice is an offence.

According to DG’s Decision 1/2015 – DG pursuant to section 33(3)(a) of GSTA gives his approval (blanket) to any registered person who makes a supply to end consumer (not businesses), to exclude following particulars in their tax invoices‐

(a) the word ‘tax invoice’ (reg. 22(a) GSTR);

(b) name and address of the recipient (reg.22(e) GSTR);

(c) the total amount payable exclusive of tax.

Credit note and Debit note – Allow the supplier to make the necessary adjustments in respect of a taxable supply after the tax invoice has been issued because there are subsequent changes (decreases or increases) in the original value of the supply. You must state the number and date of the original tax invoice in the Credit note and Debit note issue always.

The issuance of credit and debit notes by the registered person occurs when there is:

(a) a change in the rate of tax in force under section 10 of the Act or a change in the descriptions of the zero-rated or exempt supply under section 17 or 18 of the Act as the case may be; or

(b) any adjustment in the course of business such as cancellation in the supply of goods and services, under or over stated GST amount and goods returned.

and the change occurs after the return for the supply has been submitted to the Director General, a credit note or debit note shall be issued by the person making or receiving the supply.

For more information such as the requirement of issuance Electronic Tax Invoice and Sample Tax Invoice, please see GUIDE ON TAX INVOICE AND RECORDS KEEPING.

The records should be kept in Malaysia except as otherwise approved by the Director General and shall be in the national or English language, and should be preserved for a period of seven years from the latest date which the records relate.

A person is entitled to claim input tax if he is making a taxable supply and satisfies the following criteria:

(a) input tax has been incurred;

(b) input tax is allowable;

(c) he is a taxable person, i.e. a person who is or is liable to be registered;

(d) goods or services acquired in the course or furtherance of business; and

(e) goods or services made in Malaysia or any supply made outside Malaysia which would be a taxable supply if made in Malaysia.

Paragraph 38 of the GST Regulations 2014, provides that if a registered person did not claim his input tax in the taxable period in which he holds a tax invoice, the Director General may allow him to claim the input tax within 6 years from the date of supply to or importation by him.

For the purpose of claiming input tax in accordance with paragraph 38(4)(a) of GST Regulations 2014, a taxable person is considered to hold a tax invoice on the earlier of:

a. the date or time of posting the tax invoice into the company’s Accounts Payable; or

b. one year from the date he holds the tax invoice.

(see more detail at Guide on Input Tax Credit Para 10 to 12)

Input tax incurred by a taxable person in respect of the following supplies shall be excluded from any credit under GST:-

(a) the supply to or importation by him of a passenger motor car;

(b) the supply of goods or services relating to repair, maintenance and refurbishment of a passenger motor car;

(c) the hiring of a passenger motor car;

(d) club subscription fee including any joining fee, membership fee, transfer fee or other fees charged by any club, association, society or organization established principally for recreational or sporting purposes or by the transferor of the membership of such club, association, society or organization as the case may be.;

(e) any payment or contribution towards any insurance contracts or takaful certificates

(i) for indemnifying the taxable person against the cost of medical treatment to any person;

(ii) against the cost of medical treatment in which the insured or participant is any person employed by the taxable person; or

(iii) against any personal accident in which the insured or participant is any person employed by the taxable person. But does not include any insurance contract or takaful certificate against any liability which the taxable person may incur under the Employees’ Social Security Act 1969 and the Workmen’s Compensation Act 1952 where such expenses is obligatory under the act or any collective agreement within the meaning of the Industrial Relations Act 1967;

(f) any medical expenses incurred in connection with the provision of all forms of medical treatment to any person employed by a taxable person but does not include medical expenses incurred under the Employees’ Social Security Act 1969 and the Workmen’s Compensation Act 1952 where such expenses is obligatory under the act or any collective agreement within the meaning of the Industrial Relations Act 1967;

(g) any family benefits including hospitality of any kind provided by the taxable person for the benefit of any person who is the wife, husband, child including adopted child in accordance with any written law or parents of any person employed by the taxable person; and

(h) entertainment expenses to a person other than employees or existing customers except entertainment expenses incurred by a person who is in the business of providing entertainment.

However, a taxable person is allowed to claim the input tax incurred on the following expenses relating to a passenger motorcar registered in his own name:

(a) Insurance premium;

(b) Petrol, diesel and NGV;

(c) Parking; and/ or

(d) Battery certified by a competent body recognized by the DG of Road Transport Department for use in electric motor car under the Motor Vehicles (Construction and Use) Rules 1959 [LN 170/1959].

For passenger motorcar that is owned or registered under the name of other entity, any input tax incurred on the expenses listed in Guide on Input Tax Credit, Paragraph 11 are allowed to be claimed by a taxable person except the input tax on insurance premium. However, a taxable person must fulfill the following conditions:

(a) The passenger motorcar is used in his business and attributable to the taxable supply made by him;

(b) The expenses are reimbursed and accounted as his business expenses; and

(c) Hold a valid tax invoice on the expenses acquired.

Where a registered person fails to pay the consideration for the supply of any goods or services made by his supplier within six months from the date of supply and he has claimed input tax on that supply, the taxable person is required to pay back the input tax by accounting an amount equal to the input tax as his output tax. He is required to account the output tax in the taxable period covering the month after the six month period. Subsequently, he paid his supplier the consideration for the supply of the goods or services and is now entitled to claim back the said output tax as input tax for the taxable period in which he made his payment.

A person who makes both taxable and exempt supplies is known as mixed supplier. The term “partial exemption” is used to describe the situation of a mixed supplier who has to apportion the amount of residual input tax claim in respect of making taxable and exempt supplies using an approved partial exemption method. The input tax claimed is provisional and has to be adjusted annually or at the end of a longer period. This is to give a fairer and more reasonable apportionment as the amount deducted in some periods may be unfairly affected due to various reasons, e.g. due to festive season sales.

A taxable person is eligible to claim the full amount of input tax as his input tax credit if the input tax incurred by him is exclusively attributable to taxable supplies made by him, except for those which the input tax credit are disallowed under the GST Act 2014. Input tax which can be recovered by a taxable person is referred to as “taxable input” while taxable supplies means supplies on which GST is charged at standard rate or zero-rate.

On the other hand, a person is not entitled to claim input tax incurred on his acquisitions if the input tax is exclusively attributable to his exempt supplies. Input tax which is attributable to exempt supply and not recoverable as tax credit is referred to as “exempt input tax”. Exempt supplies are those supplies listed under the GST (Exempt Supply) Order 2014.

In the case of a mixed supplier, he would have incurred residual input tax in the course or furtherance of his business. Some examples of residual input tax are general overheads such as utilities charges, professional fees, rental and etc. Only the proportion of residual input that is attributable to taxable supplies is recoverable by a mixed supplier. The standard method for the residual input tax claim is the turnover method. This method is provided under Part VI of GST Regulations 2014. Before a mixed supplier applies the rule of partial exemption, he needs to exclude the amount of GST incurred for non-business use. For further information on input tax claim, please refer to the GST Guide on Input Tax Credit.

For further information, please refer to Guide on Partial Exemption

In the case of local supply including imported services or export of goods, where the supplier and the buyer are both making wholly taxable supplies and both are businesses registered for GST –

(a) the businesses may use any of the following exchange rates published by –

(b) The exchange rate from any of the published rates in sub paragraph (a) above must be –

(c) The exchange rate as in sub paragraph (a) and (b) must be used consistently for internal business reporting and accounting purposes and used for at least one year from the end of the accounting period in which the method was first used.

(d) If a GST registered person wants to use an exchange rate other than the rates as in sub paragraph (ii) (a) and (b) above, he must apply in writing to the Director General for his approval.

According to DG’s Decision 1/2015, All registered person including online business who makes taxable supply of goods or services shall display, advertise, publish or quote the price inclusive GST. Online businesses, though the price display must be inclusive of GST, they may notify customers outside Malaysia that the prices payable for goods or services brought out from Malaysia are not subject to GST.

Pre-incorporation expenditure is expenses incurred on supplies made before the incorporation of a business. Examples are secretarial services, legal services and administrative expenses. These pre-incorporation expenses are not eligible for input tax credit.

(i) Services incurred before registration (both voluntary and mandatory registration including late registration) are not eligible for input tax credit.

(ii) However, in the case of goods including capital goods, the registered person may be allowed to claim input tax on the goods he holds at the time of registration based on the approved amount by the Director General. The registered person must obtain an approval from the Director General before a claim for input tax can be made under Regulation 46 of GST Regulations 2014.

(iii) The capital goods and any services related to capital goods are not claimable under Regulation 46 of GST Regulations 2014 unless it can be capitalised according to the standard accounting principal in Malaysia, before registration date.

(iv) Input tax incurred cannot be claimed on goods that have been consumed. Consumed goods include goods which has been used partially and incorporated into some other goods.

For more information, please see GST General Guide.